Most of us who is on this page must be with a moto to get detailed insights on the questions regarding the PayPal payment platform.

In this PayPal detailed insights review, we are going to get insights on many questions like “What is Paypal?”, “How to create PayPal account?”, Paypal KYC, “How much PayPal charge for PayPal for International Transactions?”, ” How to cancel Payment on Paypal?”, alternatives and many more. So, let’s start the detailed review of Paypal:

What is PayPal?

PayPal is an online payment system or payment gateway that helps you to make International as well as Intranational transactions to buy anything globally. It also includes sending and receiving money safely and securely.

To make Paypal fully functional “you need to link your bank account, credit card or debit card to your respective account”. Now, your respective account is fully functional and ready for any type of transaction.

For Example:

You bought a Managed wordpress hosting solution from

This conversion of currency can be done through Payment Gateways like PAYPAL, Razorpay, PayU, or any other, or Credit Card or Debit cards or wallets.

How to create Paypal Account?

In this section of the Paypal review, we will learn about the possible ways to create a Paypal account. These methods are listed below:

- Visit the official website of PayPal – Link

- Click on the Sign-up Button, listed at the left top-right corner of the website.

- Now, you have to select the account you want to create – Personal Account or Business Account, then click on next Button

- Fill your phone Number then verify your number through OTP

- Now you have to fill your name, email address, and password, and then click Continue button.

- Fill your address and other required info required for KYC, and then click Continue Button

- Now you have to click the blue Get started button to add your debit, credit, or bank info.

- Verify your email address by click on the link sent by paypal on your Email address.

Before, we move ahead let us get a detailed review about the types of accounts offered by PayPal to its different customers.

The account offered by PayPal:

While our detailed Paypal review, we find it used to offer two types of accounts for two different customer bases. These two types of accounts are:

- Personal account

- Business account

Let’s discuss these two types of accounts that Paypal is offering.

Personal account

If you just need to make purchases and send money to family and friends, a Personal account is probably for you.

Some of the best examples of the use of PayPal personal Account.

- Repay a friend for your share of lunch.

- Send money as a gift.

- Buy a book online.

Paypal for Business:

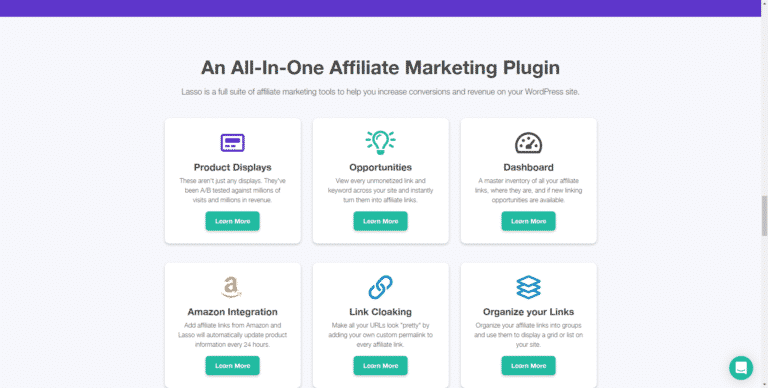

Paypal for business is nothing but a payment gateway like

With a Business account, you can:

- Operate under your company or business name.

- Accept debit card, credit card, and bank account payments for a low fee.

- Allow up to 200 employees limited access to your account.

- Sign up for PayPal products that meet your business needs,

- Set up a separate email address for your customer service issues

KYC:

The Know your Customer or account verification is one of the important phenomena for any individual or business. The KYC is done to stop money laundering.

We have listed down the process of the PAYPAL KYC that we found during our detailed review.

The whole KYC of the PAYPAL account includes four steps. These four steps are listed below:

Verify Your PAN(Tax Identity):

Your PAN (Permanent Account Number) or tax identity number is collected by PAYPAL in the first step of the Paypal account creation. For personal Paypal account, you need to give your personal PAN or Tax identification number number while in case of business you need to give business PAN number.

In case of successful verification of your tax identification. Your tax identification must verify following benchmarks:

- The name on PayPal account should match the name on the PAN card

- PAN needs to be in good standing and valid

- For Individual PANs only – the PAN needs to be linked to Aadhaar

Email Verification:

Paypal will send an email to your account in order to verify the email id is authentic.

Add a Local Bank Account:

This is to facilitate overseas payments and withdrawals to your local bank account.

PayPal Developer Account:

A Developer Account of PayPal is nothing but a solution for big e-commerce players. As this enables giants to build custom solutions like apps or website-based cart integration. For more details – Link

PayPal Customer Service:

The support offered by the PayPal use to stand alone in respect to other Payment gateway across the globe. The Paypal use to offer Phone, Chat, Email, Forum supports to its personal as well business clients.

In a case you need to call the Paypal, you need to wait approx 6 minutes in process to connect with their executives in the INDIA. While in USA, you need to wait for 3 minutes.

Now it’s great time to learn the detailed process of account activation like “How to verify Bank at Paypal?”, “How to transfer from PayPal to bank?” and ” How to add Card at PayPal?”

How to verify Bank at Paypal?

You first need to add your Indian bank account to your PayPal account. To confirm your bank account, PayPal will send 2 small deposits (each between 1.01 and 1.50 INR in INDIA) to your bank account.

The deposits should appear in your bank account in 3 to 5 business days. You can review your bank statement or contact your bank to find out the exact amounts of these deposits.

To complete the confirmation process online:

- Go to Wallet.

- Click Ready to confirm on the bank account that you’re going to confirm.

- Enter the exact amounts of the 2 deposits. For example, if the amounts you received are 1.12 and 1.07, enter 1.12 and 1.07.

- Click Confirm.

Note:

- If the amounts are entered incorrectly 3 times, your bank account will be disabled and removed from your PayPal account.

How to add Card at PayPal?

Here’s how:

- Click Wallet at the top of the page.

- Click Link a debit or credit card on the left.

- Follow the next steps to link your card.

You can also add a debit or a credit card using the PayPal App on your mobile phone. Here’s how:

- Tap on Wallet button

- Open + across from Banks and cards.

- Tap Debit and credit cards.

- Link you card manually or connect your PayPal account to your bank.

Note: When adding a card, you’ll be asked to complete 3D-Secure by your card issuing bank. To confirm that you’re the owner of the card, your card issuer may ask you to enter a security code sent to your mobile, or you may need to complete biometric authentication (fingerprint or face recognition) on your banking app.

PayPal to Bank Transfer:

There is almost two way to make transfer from Paypal to your bank account that we found during the Paypal review:

Money Transfer From PayPal Account to Bank Account

To transfer your payment from PayPal to your bank account. You need to follow following method:

- Open the PayPal app on your phone and log in,

- Click on Your PAypal Balance

- At the bottom of the screen, click on “Transfer,” and then click on “Transfer Money.”

- Click on the bank account that you want to transfer money to and then click on “Next” button

- Enter the amount of money you want to transfer and then click “Next” (For India amount automaticaly tranfer in 48 hours.

- Confirm that you want to complete this transaction by clickin on”Transfer $xxx Now” button.

- Thus, you transfered from your paypal account to bank account through App.

How to transfer money from PayPal to your bank account using a web browser like chrome, Mozilla?

For successful transfer from PayPal Account to Your bank account using a browser. You need to follow the following steps that we found during our review. these steps are listed below:

- Open PayPal.com in a web browser and log in, if needed

- Click on the Wallet button

- then Click on “Transfer Money.” button

- Click “Transfer to your bank.” button

- Select the account you want to transfer to and then click “Next.”

- Enter the amount of money you want to transfer and then click “Next.”

- Thus, you sucessfully tranfered the amount from paypal account to Bank Account using a web browser.

Cancel Payment on Paypal:

The process to cancel a payment on the Paypal use to depend on which types of the transactions you want to cancel. So, I have divided the whole Paypal cancelation process in two sub-division that we found during our review:

- Pending PayPal Payment

- Recurring PayPal Payment

How do you cancel a pending PayPal Payment?

You are not going to forget any more if you done once How to cancel the Paypal payment. To cancel the pending transactions on PayPal, you need to follow the path:

- Login into your respective account on PayPal;

- Click on Activity Buttonlisted at top of the page;

- Click on All Transation;

- Find the transaction or payment, you want to cancel;

- After selection, click on cancel cutton;

- Click on Cancel button on the next page.

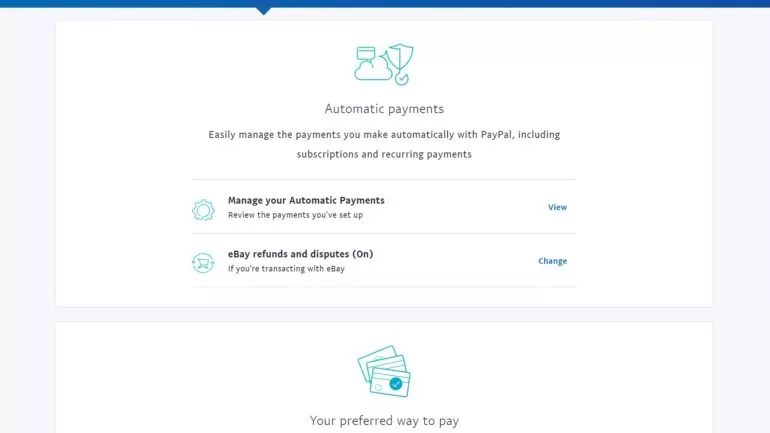

How to cancel a recurring PayPal Payment?

Recurring Payments are commonly used when you talk about recurring income or in a process of buying digital tools like

However, when you need to exist from these recurring subscription tools, you need to cancel recurring Paypal transactions and business as a addon. To successfully cancel your recurring payment(subscription) on Paypal. You must have to follow the following steps that we found during our review. These steps are listed below:

- Log into your repective PayPal account.

- Click on the username button listed at the top right.

- Select Account Settings.

- click on Money, Banks & Cards.

- Scroll down to the bottom and select Set Automatic Payments.

- Now, Select the recurring payment or subscription If you want to cancel.

- then, Select Cancel.