As a blogger or Affiliate marketer or content creator, we often need solutions to get paid or send payment internationally.

If you bulk process bulk payment on a regular basis, it’s very easy to get paid as you can integrate payment gateway like razorpay to your website or platform.

While if you need to do only one or two payments on a monthly basis, you need a low-cost international money transfer solution.

But when we go the search for the international money transfer solution, most of us got shocked as 99% of the providers used to quote “they offer the best money exchange rates.”

So, in this article, we are going to learn the best way to do a low-cost international transfer.

What is International Money Transfer?

The international money transfer is almost the same in comparison to the money transfer from one person to the second person via UPI. There is one basic difference between both and the difference is its geo-location.

For Example:

I work for a USA based client and developed a WordPress website for him and I use to live in India. He wants to pay 300 USD for this payment and I want the amount in INR. So, he sends a payment from his bank and I got the PAyment in INR.

The payment sent by him to me is in USD and my bank receive the amount in USD. But, this amount has been converted to INR by my bank. This amount is converted on the basis of the conversion ratio offered by the bank.

How to do an international Transaction?

In this section, we are going to learn the methods through which we can transfer money internationally.

To do a successful transaction, we have two ways i.e BANK transfer(Wire Transfer) and Wallet Transfer. For a successful wire transfer, you only need to go to your respective bank and fill a form and you are done. While the payment gateway is simple to use.

Best Ways to Transfer Money internationally:

There are a lot of ways to transfer money in a very cost-effective manner. Some of these methods are listed below:

Paypal:

PayPal is an online payment system or payment gateway that helps you to make International as well as Intranational transactions to buy anything globally. It also includes sending and receiving money safely and securely.

To make Paypal fully functional “you need to link your bank account, credit card or debit card to your respective account”. Now, your respective account is fully functional and ready for any type of transaction.

For Example:

You bought a Managed wordpress hosting solution from cloudways which is a European company and you live in my beloving country INDIA. The company ask for payment in form of US dollar but you have Indian Rupees.

This conversion of currency can be done through Payment Gateways like PAYPAL, Razorpay, PayU, or any other, or Credit Card or Debit cards or wallets.

Fees for international Transaction:

Paypal use to ask 4% on the conversion charge. This is the highest limit any bank entity can ask for an international money transfer.

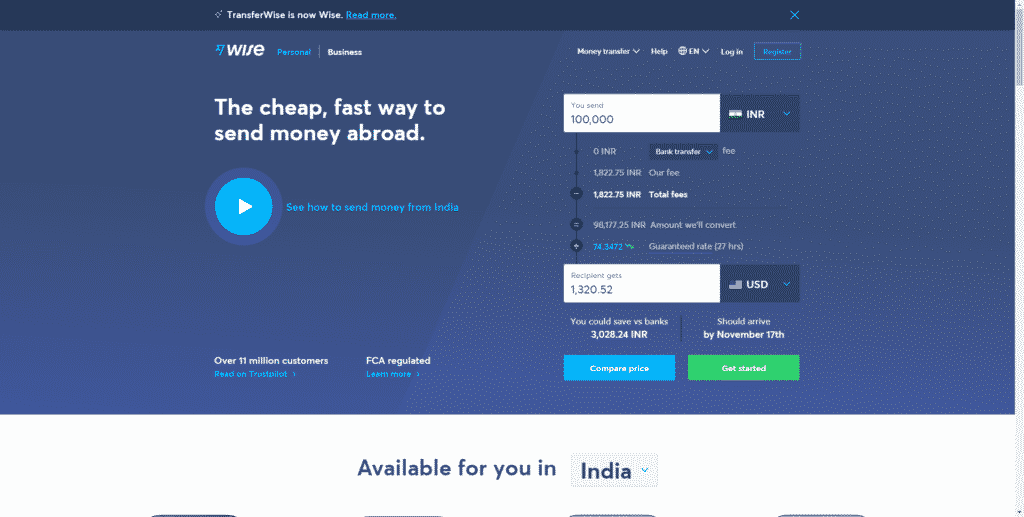

Wise: Formally Transferwise

Wise is an international payment system or payment gateway like any other wallet. It use to offer you to send and receive or transfer international money in a very low-cost manner.

To make wise fully functional payment system “you need to link your bank account, credit card or debit card to your respective account”. Now, your respective account is fully functional and ready for any type of transaction.

Fees:

You need to pay flat 4.39 dollars for every successful transfer of money. This high cost makes it a costlier option if you transfer money below $200 while it’s a cost-effective manner to transfer in bulk amount.

Global Reach:

Global reach is a USA based low-cost high volume international money transfer solution.

Managing foreign exchange and international payments is their speciality. The knowledge, experience, and expertise allow global reach to proactively manage your currency exposure, providing customised solutions that help you mitigate the risks currency markets can create.

Fees:

The fees offered the Global reach is based on case to case basis.

Revolut:

Revolut Technologies Inc. is a technology services provider and administrator of the card program. Travel insurance on Revolut’s paid plans is provided by Chubb Group. Cryptocurrency services are provided directly by Paxos Trust Company. Savings Vault services are provided by Sutton Bank, Member FDIC.

The most important part of the revoult is “it offers currency conversion in a real-time manner.

Moneycorp:

Moneycorp is a USA based low-cost international transfer and conversion company.

Moneycorp is a trading name of TTT Moneycorp Limited, a company registered in England under registration number 738837. Its registered office address is on Floor 5, Zig Zag Building, 70 Victoria Street, London SW1E 6SQ and it is VAT registration number is 897 3934 54. TTT Moneycorp Limited is authorised by the Financial Conduct Authority under the Payment Service Regulation 2017 (firm reference number 308919) for the provision of payment services.